5 Ratings on Google Play Store

Build Wealth with Clarity. Confidence. Consistency

We help individuals and families feel financially secure by building the right balance of investments, insurance, and long-term planning, so life’s uncertainties never derail your future.

Our Approach to Financial Security

A Structured 6-Step Planning Process

Understanding You & Your Goals

We begin by understanding your life goals, responsibilities, income, and expectations. This helps us establish a clear purpose behind every financial decision.

Gathering Financial Information

We collect details of your current investments, insurance coverage, liabilities, expenses, and savings to get a complete picture of your financial health.

Identifying Gaps & Opportunities

We analyze your financial data to identify gaps in protection, inefficiencies in investments, and opportunities to improve growth and stability.

Creating a Personalized Financial Plan

Based on your goals and risk profile, we develop a customized plan that balances protection (insurance) and growth (investments).

Putting the Plan into Action

We help you implement the plan through the right investment strategies, SIPs, insurance solutions, and asset allocation.

Tracking, Rebalancing & Adapting

Life changes, markets change and so should your plan. We review your portfolio regularly to ensure it stays aligned with your goals.

We Don’t Sell Products,

We Build Financial Peace!

At Tradepy, our focus isn’t on selling investments or insurance.

Our focus is on WHAT’S RIGHT FOR YOU.

Financial Stress Ends Where Planning Begins

We take the stress of financial decisions off your shoulders so you can live your life with confidence, knowing your money is planned, protected, and working in the right direction.

Growth & Scaling

Life-Centric Planning

Life doesn’t stay the same and neither should your financial plan.

At Tradepy, your plan evolves as your income, goals, responsibilities, and priorities change. Whether you’re starting out or scaling your wealth, we adapt your strategy to keep you financially secure at every stage.

You’re Not Alone in Your Financial Journey

Financial decisions can feel overwhelming but you don’t have to make them alone.

At Tradepy, we walk with you through every stage of life, helping you make confident decisions.

Testimonials & Reviews

Hear From Our Happy Clients: Their Stories

At Tradepy, client trust isn’t a marketing statement, it’s the foundation of everything we do.

Shivam Yadav

Certified Ethical Hacker

I’ve been in touch with Tradepy for a while now, and I’m genuinely impressed. The app is smooth and user-friendly, but what truly sets it apart is the support from the Relationship manager. He is incredibly helpful, always available to clear doubts, and consistently shares smart, long-term financial plans tailored to individual goals. His proactive approach and deep market knowledge have really helped me invest more confidently. Highly recommended for anyone serious about growing their wealth.

Dhyey Rupabheda

Executive Capital Market

Tredepy is a promising platform with a clean interface and smooth experience. It helps simplify financial tracking and gives confidence while managing money.

Kiran Rajguru

Accounts Manager

As an Accounts Manager, I appreciate structured and well-organized financial solutions. Tradepy’s app makes tracking investments simple and transparent, while the advisory support helped me plan my finances more efficiently with a clear long-term perspective.

Harshali Pawar

Pharma Industry

Super impressed with the Service! Financial planning has never felt this effortless. The advice is crystal clear, and everything is designed to actually help you take action.

Aprna Golhe

Shipping Industry Professional

My income patterns and financial needs are different. Tradepy understood this well and offered personalized guidance. The app is user-friendly, and having everything from investments to goal planning in one place has made managing my finances much easier.

Jay Khuman

Football Coach

I’ve always been a little anxious about managing my money, but tradepy has completely changed that. With professional backing every step, I finally feel in control. The interface is smooth, and the insights are spot on!

Mahesh Loke

Team Lead – Certified Ethical Hacker

Tradepy has played an important role in helping me understand and plan my finances with clarity and confidence.

They don’t just suggest investments they educate, guide, and genuinely care about long-term financial growth.

In an industry where trust matters the most, Tradepy stands out with transparency and discipline.

Truly proud to see my close friends build something so reliable and impactful.

Upasana Palkar

Lawyer

As a lawyer, clarity and accuracy matter to me. Tradepy helped me structure my finances in a simple and transparent way. The app makes it easy to track investments, and the advisory support gave me confidence that my financial planning is aligned with my long-term goals.

Omkar Pawar

Mechanical Engineer

Tradepy offers a refined approach to financial management. The platform delivers clarity, control, and consistency, supported by thoughtful guidance that aligns investments with long-term goals.

YourMoneyMentors educates.

Tradepy implements.

YourMoneyMentors is our education-first initiative created to simplify finance and help individuals feel confident about their money without pressure, jargon, or selling.

We believe that when people truly understand their finances, better decisions follow naturally.

Frequently Asked Questions

Got Questions? We’ve Got Answers.

Are there any fees for financial planning at Tradepy?

No. There are no upfront or hidden fees for financial planning.

Tradepy is an AMFI-registered Mutual Fund Distributor, and we are compensated through commissions paid by the respective AMCs. This allows us to offer planning support without charging clients directly.

How can I start my financial planning journey with Tradepy?

Getting started is simple.

You just need to connect with us or give us a call. Our team will schedule a one-on-one discussion to understand your goals, income, responsibilities, and risk profile. From there, we guide you through the complete financial planning process.

How often is my portfolio reviewed?

Your portfolio is reviewed periodically and also whenever there is:

- A major life change

- A shift in financial goals

- A need for rebalancing

Regular reviews help ensure your plan stays aligned with your life.

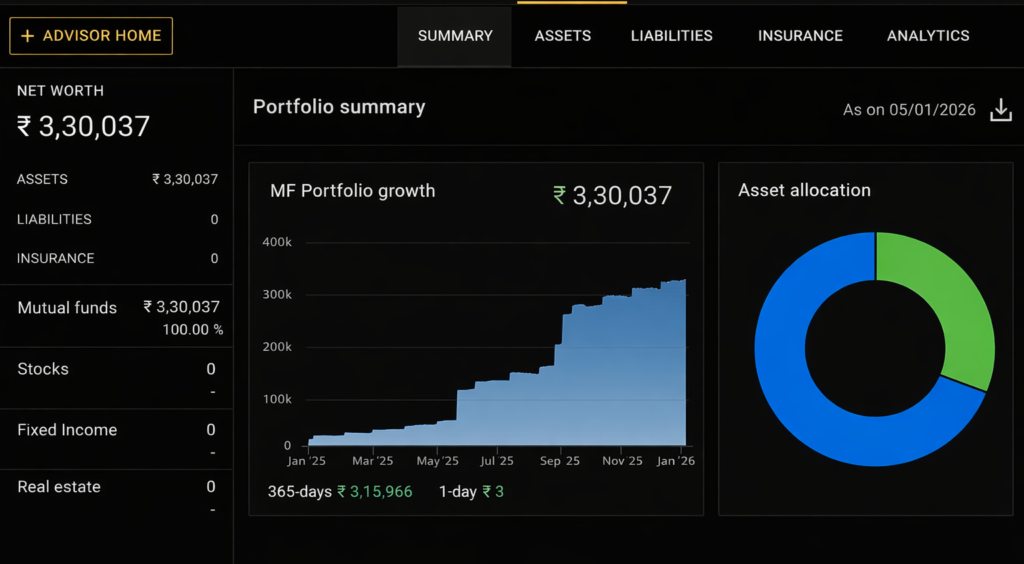

How can I track and view my investment portfolio?

You can easily track your investments digitally.

- Android users: Download Tradepy – Your Finance Guide from the Google Play Store

- iOS users: Use My Planner app

Both platforms allow you to view your portfolio, track performance, and stay updated anytime.

Can I adjust or manage my portfolio on my own?

Yes, absolutely.

You have full flexibility to manage or adjust your portfolio yourself. At the same time, a dedicated financial planner is always available to assist you with decisions, rebalancing, or guidance whenever needed.

Do you only advise on mutual funds?

No.

While mutual funds are an important part of wealth creation, our approach is holistic. We also help you with:

Long-term financial security

Insurance planning

Asset allocation

Goal-based planning

Is my money safe with Tradepy?

Your investments are held directly with SEBI-registered AMCs, not with Tradepy.

Tradepy acts as your advisor and facilitator, ensuring transparency, safety, and proper documentation at every step.

Let’s Build a Financially Secure Future Together!

We don’t sell.

We don’t rush.

We do what’s right for you.

That’s the Tradepy promise.